Ask any CFO what concerns them about Accounts Payable (AP) management solutions and they’ll likely cite delays in payment processing and vendors being switched to card payments without authorization. Just this morning, a reddit user who uses one of the leading bill pay platforms announced:

“I am getting out ASAP and pulling all of our vendors off.” In the bookkeeping subreddit he complained, “they charge you to use them, charge you per check/ACH sent, charge the vendor a percentage, and they are collecting the float on what seems to be millions everyday. I am currently researching alternatives to this platform.”

The AP market has long been dominated by a few well-established providers, software giants who maximize their own profits not only through subscription fees, but by making money on their customers’ money. In addition to the fees they charge to process data, they also hold their customers’ cash for their own gains. As many of these companies are public companies a quick scan of their 10k will reveal the hundreds of millions of dollars earned from fees, interchange and interest collected from payment transactions.

For too long, businesses have been trapped in this one-size-fits-all approach, where AP software providers dictate fees, where cash is held, and when/how vendors are paid.

Enter PaperTrl, a game-changer in the AP market. We are rewriting the rules and empowering businesses by allowing them to take back control of their financial relationships with their vendors – as well as their cash. We seek to remake the model for Accounts Payable management platforms and reset the expectations of customers in the industry.

You decide which payment method

We love virtual cards. We love the security, the convenience, and the speed of payment they offer. We also love that our customers can participate in rebates from the card issuers – all great stuff. According to US Bank and the Institute of Commercial Payments, virtual cards are the fastest growing B2B payment method on the planet. We also recognize that even for vendors who already accept card, virtual cards are not the best option for all payments.

What we don’t love, and believe hurts vendor relationships, is the practice used by some of our competitors of delaying vendor payments in an effort to convert an ACH or check payee to virtual card. We also believe that, in the long term, this practice hurts the adoption of virtual cards as merchants begin to develop negative perceptions about the use of the card.

One of the key ways PaperTrl is changing the AP market is by empowering customers to choose their own payment methods. With PaperTrl, you have the flexibility to select vendor payment methods in real-time and pay your vendors using the methods that work best for you and your business. Whether it’s traditional checks, ACH transfers, wire transfers, or even emerging digital payment methods, PaperTrl has you covered.

Seamless integration out-of-the-box

Integration has always been a pain point for businesses when adopting new software solutions. AP management is no exception. PaperTrl recognizes this challenge and has taken it head-on providing out-of-the-box integration capabilities for the most popular cloud accounting systems such as QuickBooks Online (QBO) and Microsoft Business Central. PaperTrl integration can be set up in just minutes ensuring that your transition to our platform is smooth and hassle-free. No more costly and time-consuming custom development – we’ve done the hard work for you.

All your expenses under one roof

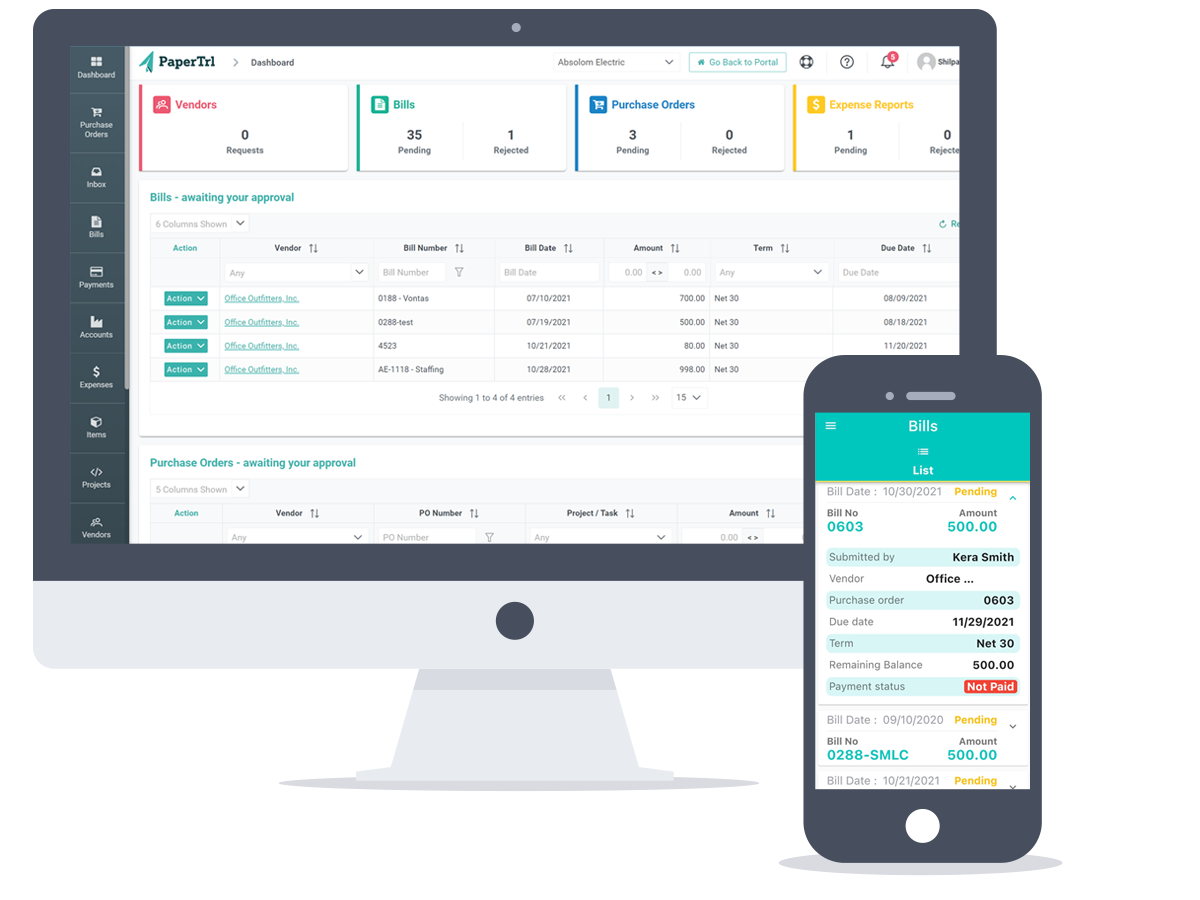

PaperTrl doesn’t stop at just processing invoices; we go the extra mile by including 100% of your non-payroll spend in our system. That means we handle everything from expense reports to credit card statements and vendor invoices. Say goodbye to the headache of managing multiple systems and processes for different types of expenses. With PaperTrl, you can finally have a comprehensive view of all your spending in one place, both from the desktop and on mobile.

We focus on fast, not float

One of the most striking ways that PaperTrl distinguishes itself from competitors is our commitment to accelerating the movement of approved payments between our customers and their vendors. PaperTrl is unrelenting in challenging our payment partners to expose newer and faster methods of executing payments. While we can match any of our competitors virtual card capabilities, we do not share their myopic view that virtual cards is the best payment method for all vendor bills.

Some of our competitors see real-time payments as a threat to major portions of their revenue streams telling their shareholders “Widespread adoption of new forms of electronic payments, such as real time payments, could also negatively impact the revenue ($198.6 million) we receive from electronic payment transactions (like virtual cards and ACH)”. Unlike some competitors who earn tens of millions of dollars each quarter by earning interest on their customers’ cash (often referred to as “float”), PaperTrl takes a different approach. Our platform sends signals to your financial institutions trusted systems to initiate payments.

At no point does PaperTrl directly or indirectly receive (or hold) your money or its equivalents. Your payments stay in your control and move directly from your bank to your vendor’s bank or whatever path you choose. In other words, your funds remain your own, and we don’t profit from the interest they could generate.

PaperTrl: A better way to AP

In a market where innovation has been long overdue, PaperTRL is changing the game. We put your needs first, offering payment freedom, hassle-free integration, comprehensive coverage, and transparent service. It’s time to break free from the constraints of the status quo and embrace a future where your business’s financial well-being is truly in your hands. Join us in revolutionizing the AP market – the power is yours.